By Ginger DeShaney

Interest rates are wreaking havoc on the real estate market.

Interest rates are wreaking havoc on the real estate market.

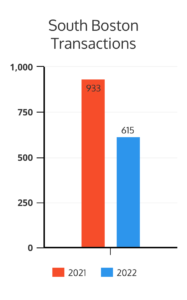

In South Boston, real estate transactions in 2022 were down 34 percent from 2021, but at the same time, median prices have increased, said a longtime South Boston realtor.

In 2021, there were 933 transactions; in 2022, that number was down to 615, of which 467 were condos.

“It’s not shocking given what happened with the interest rates spiking up,” said Jackie Rooney, broker/owner of Rooney Real Estate. “The interest rate is the main culprit.”

Sales volume of condos and single-family and multi-family homes is down almost $300 million in 2022, Rooney said, noting that almost 40 percent of that amount came in the fourth quarter.

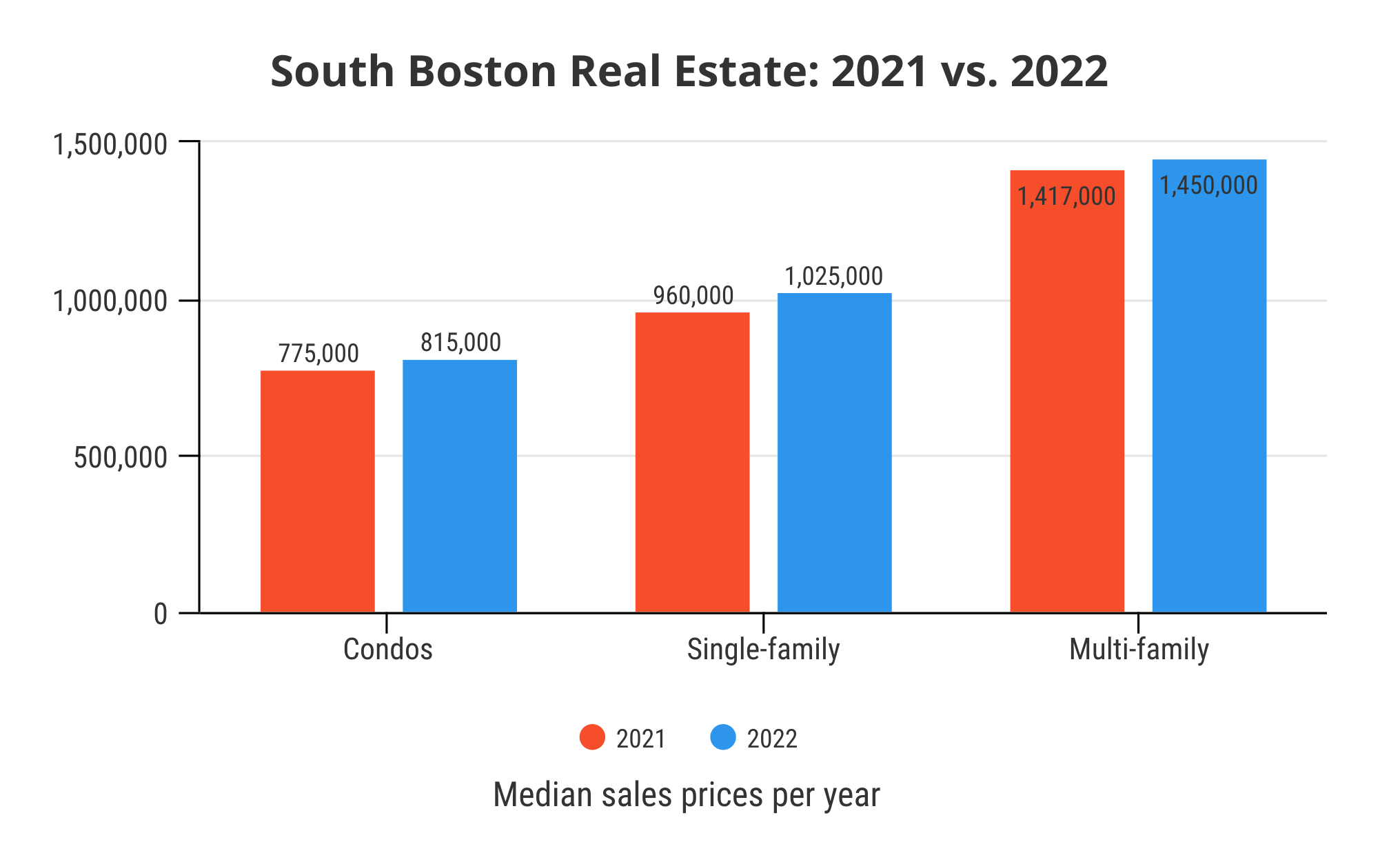

Increasing median prices are a testament to the South Boston market’s resilience:

- Condos: $775,000 in 2021; $815,000 in 2022.

- Single-family: $960,000 in 2021; $1,025,000 in 2022

- Multi-family: $1,417,000 in 2021; $1,450,000 in 2022

How do prices go up in a down market?

“There’s no inventory,” Rooney said.

Currently in South Boston, only 35 condos are on the market (in the neighborhood, condos make up almost 85 percent of sales). That’s less than a month’s worth of inventory, Rooney said. “That’s way too low.”

It all comes down to supply and demand.

Some homeowners are reluctant to sell because their interest rate was around 3 percent at the time of their purchases.

Rooney is not seeing as many condo developers applying for permits right now because of high material, labor, and carrying costs.

“So you’ve got the phenomenon of sellers saying ‘OK, we just have to hold pat in the condo and wait until the rates come down a bit before we move to suburbia,’” Rooney said. “And developers are probably not developing at the same pace they were in 2019 and 2020 and the result is 35 condos on the market.”

Regarding single-family median prices going up almost 7 percent, Rooney is seeing more families who want to stay in the city as evidenced by the number of Catholic school applications being way up.

Rooney hasn’t seen interest rates shoot up like this in such a short time, noting rates in February were 3 percent but by May they were 6.5 percent.

Rooney is hopeful that the first quarter of 2023 will be a bit of an uptick from the fourth quarter of 2022.

“The million dollar question is, how bad will the recession be and where will the interest rates go?”