By Ginger DeShaney

The third quarter of 2022 held some local real estate market surprises.

“Some things even surprised me,” said long-time South Boston realtor Jackie Rooney. “The big change is the number of sales is down 30%.”

But the bigger surprise is that prices held through the year’s first three quarters, although many of these transactions went under agreement when the rates were lower (from November 2021 through March 2022).

At the end of the third quarter in 2021 (year to date through Sept. 30), there were 756 transactions; this year, that number is 531.

“Some of it is due to the interest rate, and maybe people were reluctant to sell,” said Rooney, broker/owner of Rooney Real Estate.

Even if some homeowners prefer to sell, will they give up a 2.75 percent interest rate to pay 6.25 percent? Rooney asked. “There’s some of that in play,” he said.

But the COVID-19 pandemic was also a factor. “I think last year was a historic year in sales,” Rooney said.

He had several listings he was expecting in 2020 that got pushed into 2021 when the pandemic shut everything down. “So I’m assuming if I had some, everyone else did, too. And I think that’s why in 2021 the number of transactions was so high.”

Of the 571 transactions in 2022, 448, or 84 percent, are condos. The median sales price for condos is up 6 percent; the median sales price per square foot is up 6.5 percent.

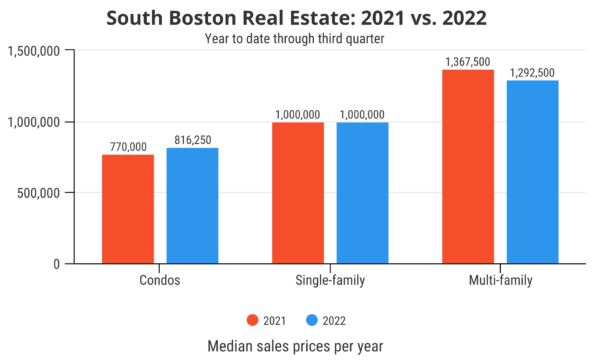

The median sales price for a condo as of Sept. 30, 2022, is $816,250, up from 2021’s price of $770,000. The price per square foot is $815 in 2022 as compared with $765 in 2021.

The price of single-family homes has remained the same: $1 million for both years. This year to date, 45 singles have been sold to last year’s 49. The price per square foot has increased 8 percent, though, to $639, up from $593 in 2021.

For multi-family transactions, 46 were sold last year to date; this year that number is 38. Prices are down for multi-family homes: in 2021, the median sales price was $1,367,500; this year it’s $1,292,500; but the price per square foot went up this year – $600 from $524 last year.

“So that tells me smaller singles and smaller multis sold, and they fetch more per square foot,” Rooney said.

One interesting note on multis: Last year, multis averaged 42 days on the market; this year, they average 19 days.

Inventory is also down right now. There are only 85 condos on the market as of 9/30, compared with 114 last year at this time, a 25 percent decrease. Those 85 condos represent two months’ worth of inventory, as do the nine single and nine multis on the market now.=

A stable market is 4-6 months of inventory, Rooney said, so there’s not a whole lot to choose from.

“There’s a disconnect between sellers’ expectations and buyers’ buying power. And that can take upwards of six months to sort itself out.”

Rooney said the sellers may not get what they could have gotten for their property a year ago, but the property they’re buying won’t cost as much. “That’s what usually happens when it sorts itself out.”

Rooney warned that there are storm clouds ahead. “When we look at current inventory, days on the market have gone up … 81 percent from 22 to 38 days, and we see quite a few price drops.”

Stay tuned!

175 West Seventh Street #3

Penthouse condo, a 2017 renovation, 900 square feet, 2 bedrooms, 1 bath with a roof deck and deeded parking.

Sold by Rooney Real Estate for $810,000

111 O Street

Single-family, 2,016 square feet, 8 rooms, 5 bedrooms, 2+ parking spaces.

Sold by Rooney Real Estate for $1,512,500.